30+ 5 year arm mortgage calculator

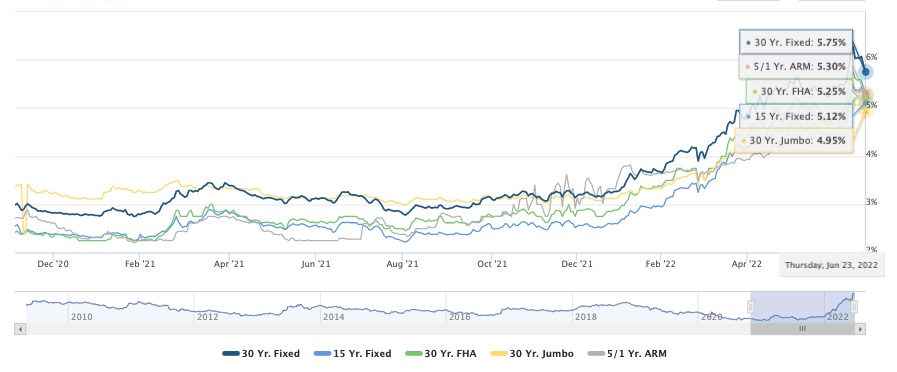

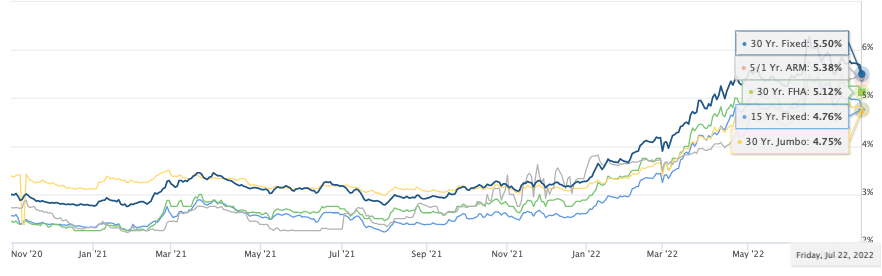

The following table shows current Redmond 30-year mortgage rates as that is the most popular choice by home buyers across the United States. The most common ARM product is the 5-year Adjustable Rate Mortgage which commonly comes with an interest rate that is typically 025 to 1 less than a 30-year.

![]()

Best 10 Mortgage Calculator Apps Last Updated September 12 2022

Balloon Loan Calculator.

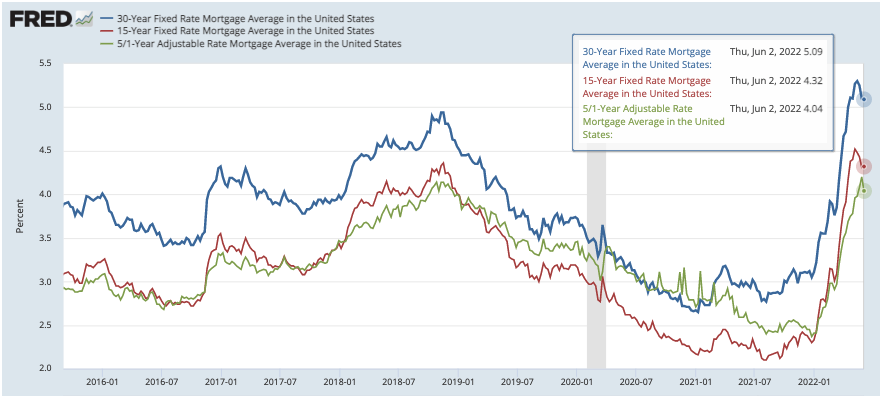

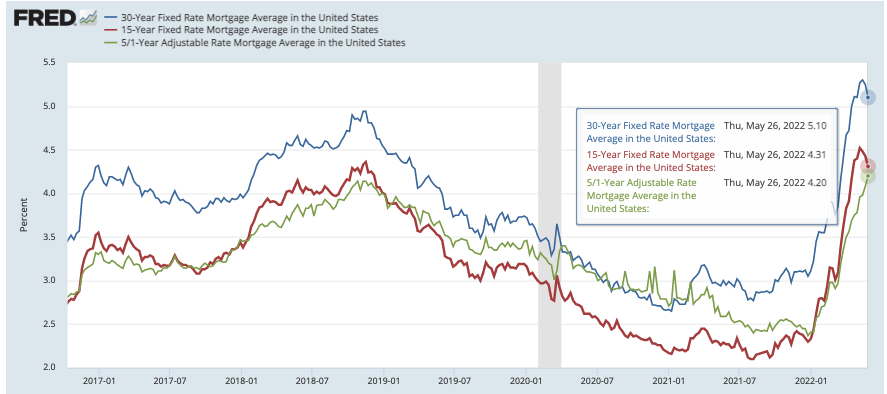

. The spreads change over time but the 15-year is typically about a half a percent lower than the 30-year. 185 percent of your loan amount per year billed monthly. 15 Year Fixed 30 Year FHA 30 Year Jumbo 51 ARM.

A 30-year fixed-rate mortgage has a 30-year term with a fixed interest rate and monthly principal and interest payments that stay the same for the life of the loan. 30-Year Mortgages and Extra Payments. Mortgage Amount Interest Rate Mortgage Term years.

Safis says the average rate difference between a 106 ARM and a 30-year fixed mortgage can be about 05 to 075. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily Freddie Mac etc. As mortgage rates rode a rollercoaster through the 1980s.

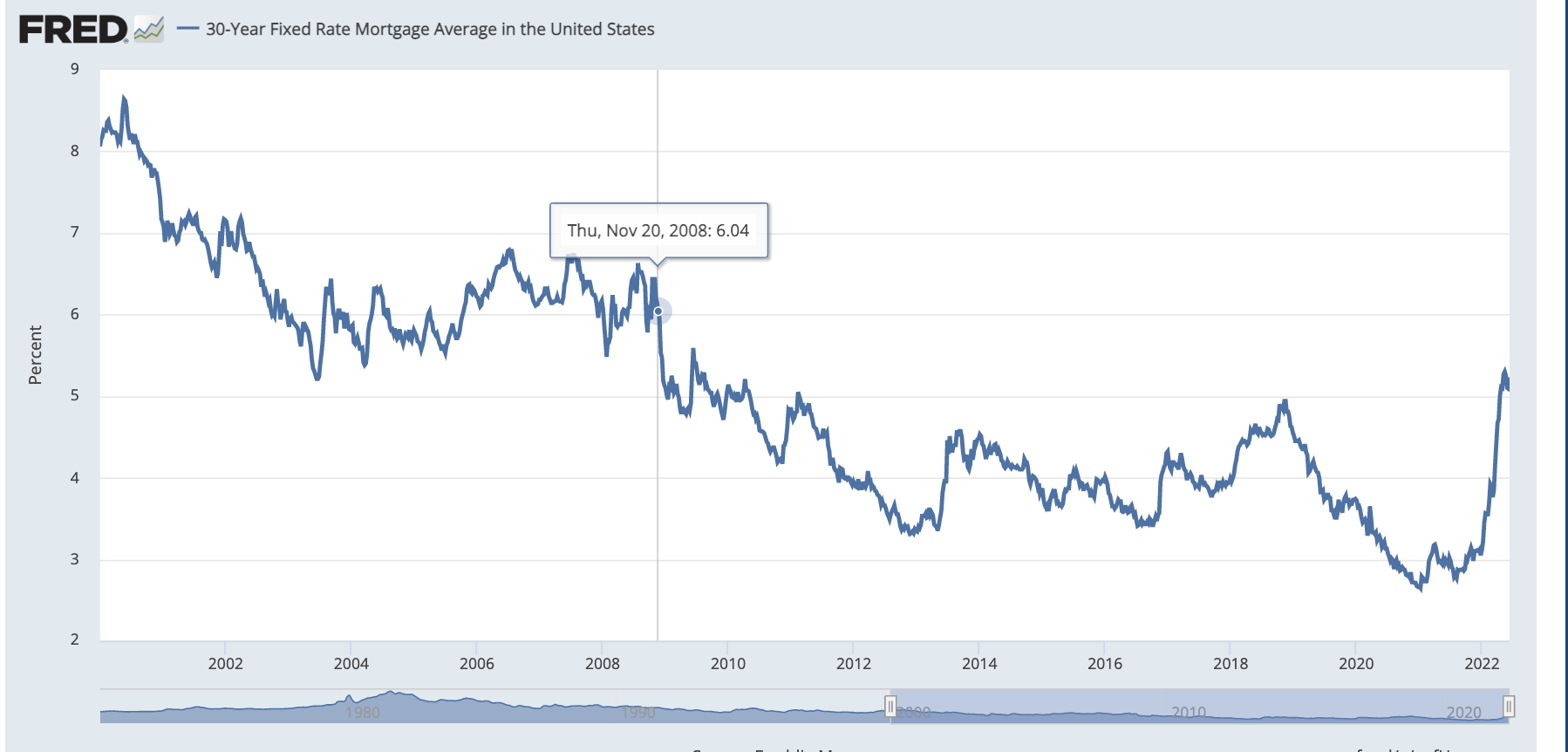

Based on the FRED graph the 30-year fixed mortgage started with an average rate of 815 percent in January 2020. The most common ARM loans are 51 71 loans with the 31 101 being relatively less popular. But with current mortgage rates hovering around historic lows todays 5-year ARM loan intro rates have aligned more closely with 30-year fixed rates.

While both loan types have similar interest rate profiles the 15-year loan typically offers a lower rate to the 30-year loan. Includes fixed 30-year mortgage rates for FHA VA and conventional loans plus advice to find your best rate. Loans can also be structured using other less common formats.

Simple Mortgage Calculator. After the introductory period is up the loans rate regularly adjusts every 6-months to year based upon a reference rate like the London Interbank Offered Rate LIBOR or the 11th. Youll have paid down about 12 percent of the balance of the 51 30-year ARM while.

To find out if a 10-year mortgage is right for you do the math using the Bankrate Mortgage Calculator. All have 30-year terms but the first number 5 7. A 51 ARM used to be a type of 5-year adjustable-rate mortgage where the interest rate was fixed for the first 5 years and then adjusted annually for the remainder of its term.

We offer a calculator which makes it easy to compare fixed vs ARM loans side-by-side. How does a 30-year fixed-rate mortgage compare to an ARM. Why use an amortization calculator.

Over the next couple of years between 2001 to 2008 it fluctuates between 707 percent and 585 percent. As of January 10 2021 the average mortgage rate for a 30-year FRM is 265 APR while the average interest rate for a 15-year FRM is 216 APR. For example one could have a 55 ARM which reset rates every 5 years.

Mortgage loan calculator. Or one could have a 228 or 327 ARM. Bankrates mortgage amortization calculator shows how even a 01 percent difference on your rate can.

A 71 ARM used to be a type of 7-year adjustable-rate mortgage where the interest rate was fixed for the first 7 years and then adjusted annually for the remainder of its term. 5-year ARM rate comparison. The now retired 51 ARM loans were based on a benchmark known as LIBOR London Inter-Bank Offered Rate that will cease to be published by 2023.

If calculating the monthly payment on a 30-year fixed-rate mortgage valued at 200000 with a 3 interest rate the PMT function would look like the below and return a monthly payment amount of 843. Most homebuyers choose the 30-year fixed loan structure. Its popularity is due to low monthly payments and upfront costs.

Most homebuyers in America tend to obtain 30-year fixed-rate mortgagesAs of June 2020 the Urban Institute reports that 30-year fixed-rate loans account for 77 percent of new mortgages in the market. 30 Year Fixed Rate. This allows you to secure a lower rate and pay your mortgage earlier.

An easy way to do the math and. The most common ARM loans are 51 71 loans with the 31 101 being relatively less popular. Find and compare 30-year mortgage rates and choose your preferred lender.

15 years vs 30 years. 51 ARM 51 ARM 30 Yr. 30 Year Fixed 15 Year Fixed 30 Year FHA 30 Year Jumbo 51 ARM 30 Year VA 30 Year Jumbo Mortgage Rates Average 30 year fixed JUMBO mortgage rates from Mortgage News Daily and MBA.

The now retired 71 ARM loans were based on a benchmark known as LIBOR London Inter-Bank Offered Rate that will cease to be published by 2023. When mortgage rates are at a low interest period a fixed-rate mortgage may make the most sense. Loans can also be structured using other less common formats.

For example one could have a 55 ARM which reset rates every 5 years. The most common ARM loans are 51 71 loans with the 31 101 being relatively less popular. Learn more about 30-year mortgages What is a 30-year fixed-rate mortgage.

Loans can also be structured using other less common formats. For example one could have a 55 ARM which reset rates every 5 years. Meanwhile the current average 30-year fixed-mortgage rate is 608.

This mortgage calculator makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan. However when interest rates are rising its a different market. The 51 71 and 101 ARM.

An adjustable-rate mortgage ARM has an interest rate that will. If youve taken a 30-year FRM you can refinance to a 15-year term after a couple of years. The limit for single family homes in 2022 is 647200.

Or one could have a 228 or 327 ARM. Use a mortgage payment calculator. Conforming loans have a price limit set annually with high-cost areas capped at 150 of the base cap.

Or one could have a 228 or 327 ARM. If you would like to compare fixed rates against hybrid ARM rates which reset at various introductory periods you can use the loan type menu to select rates on loans that reset after 1 3 5 7 or 10 years. Here are some of the advantages of a 15-year mortgage over a 30-year mortgage.

ARMs first became available to American homeowners in 1981 a year when the average rate on a 30-year loan surged past 18 percent. Typically a 5-year ARM offers a lower interest rate than a 30-year fixed-rate mortgage.

St Louis Interest Rates St Louis Real Estate News

Best 10 Mortgage Calculator Apps Last Updated September 12 2022

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

![]()

Best 10 Mortgage Calculator Apps Last Updated September 12 2022

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Your Adjustable Rate Mortgage Needs To Be Refinanced

Best 10 Mortgage Calculator Apps Last Updated September 12 2022

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Current Adjustable Rate Mortgage Rates Arm Rates Freeandclear

St Louis Interest Rates St Louis Real Estate News

Your Adjustable Rate Mortgage Needs To Be Refinanced

St Louis Interest Rates St Louis Real Estate News

![]()

Best 10 Mortgage Calculator Apps Last Updated September 12 2022

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

How Is Buying A House With A Mortgage A Good Investment If You End Up Paying Nearly Double Because Of The Interest 350k Loan 3 375 Total Is Over 500k By The End

St Louis Interest Rates St Louis Real Estate News

St Louis Interest Rates St Louis Real Estate News